Debt financial instruments. Debt financial instruments and their types. Public debt management tools

When analyzing investment activity in general, and investment processes on the securities market, in particular, it is necessary to include the concept of financial instrument .

In International Financial Reporting Standards (IFRS) under financial tool refers to any contract that simultaneously creates a financial asset for one party and a financial liability or equity instrument for the other party.

Concept of contract is fundamental in defining a financial instrument.

In accordance with Art. 420 Civil Code of the Russian Federation agreement recognized agreement between two or more parties(persons) about establishment, modification or termination of civil rights and obligations .

The conclusion of an agreement presupposes the assumption by its parties of certain obligations.

Commitment there is some relationship between the parties involved. According to Art. 307 of the Civil Code of the Russian Federation, by virtue of an obligation, one person (debtor) is obliged to perform a certain action in favor of another person (creditor), such as: transfer property, pay money, etc. or refrain from a certain action, and the creditor has the right to demand from the debtor the fulfillment of his obligations.

At the same time, in determination of a financial instrument we're talking about only those contracts that result in changes in financial assets and liabilities. These categories have not civil law , A economic nature.

TO financial assets relate:

Cash (cash at the cash desk, as well as in settlement, foreign currency and special accounts);

A contractual right to claim cash or another financial asset from another company (for example, a receivable);

The contractual right to exchange financial instruments with another company on mutually beneficial terms (for example, an option on bonds);

An equity instrument of another company (shares, units). A financial obligation is any obligation under a contract:

Provide cash (or other financial asset) to another company (for example, accounts payable);

Exchange financial instruments with another company.

Equity instrument - This is a way of participating in the capital (authorized capital) of an economic entity.

In addition to equity instruments, a significant role is played in the investment process. debt financial instruments - loans, loans, bonds - which have specific property and legal features, which, in turn, entail corresponding consequences for the issuers of these instruments (lenders) and holders of the instruments (borrowers).

So, we can highlight two species characteristics, allowing one or another procedure or operation to be qualified as related to financial instrument:

The basis of the operation should be financial assets and liabilities;

The operation must have contract form.

Thus, financial instruments are by definition contracts and can be classified accordingly (Figure 1).

Financial instruments are divided into:

ü primary (cash, securities, accounts payable and receivable from current transactions) And

ü secondary (derivatives) /derivatives/ ) (financial options, futures, forward contracts, interest rate swaps, currency swaps).

Under the term "financial instruments" also refers to various forms of short-term and long-term investment, which are traded on financial markets. These include cash, securities, options, forwards, futures and swaps.

Securities - these are monetary documents certifying the ownership or loan rights of the owner of the document in relation to the person who issued such a document (issuer) and bears responsibility for

Rice. 1. Generalized diagram of financial instruments

obligations to him. Among the securities circulating in Russia, we highlight the following: shares, debt securities, financial futures, commercial paper (checks, bills of lading, mortgages, certificates of pledge, etc.). A specific type of securities intended for the initial stage of the privatization process in Russia (check privatization) were privatization checks (vouchers).

In accordance with the legislation, the following types of securities are traded in Russia:

Shares of joint stock companies- any securities that certify their owner’s right to a share in the company’s own funds and to receive income from its activities. Shares are financial investments in the equity capital of an enterprise in order to receive additional income, consisting of the amount of dividends and capital gains invested in shares due to growth their prices.

Bonds- any securities certifying the loan relationship between their owner (creditor) and the person who issued the document (debtor);

Government debt obligations- any securities certifying a loan relationship in which the debtor is the state, public authorities or management;

Derivatives- any securities certifying the right of their owner to purchase or sell the above securities.

Debt securities represent obligations placed by issuers on the stock market to borrow funds necessary to solve current and future problems. These include bonds, deposit and savings certificates of banks, government short-term obligations, short-term bank bills, treasury bills and notes, bills accepted by the bank, debt certificates, etc.

The most common form of debt is bond. This is a security that certifies that its owner has deposited funds and confirms the obligation to reimburse him the nominal value of this security within the period specified in it with the payment of a fixed percentage, unless otherwise provided by the terms of the issue.

There are bonds of internal state and local loans and bonds of an economic entity (joint stock company, commercial bank, etc.); the former are issued only to bearer, the latter can be issued both registered and to bearer.

Thus, Vnesheconombank domestic foreign currency loan bonds (web news)) appeared on May 14, 1993, when VEB issued them to enterprises that had correspondent accounts for a period of 1,3,6, 10 and 15 years. The face value of the bond is 1.10, 100 thousand dollars. The annual income is paid at the rate of 3% per annum. The secondary market for these securities is relatively poorly developed due to their low profitability . However, these securities have one advantageous difference - they are listed on world stock markets.

Housing certificates - one of the types of bonds with indexed nominal value, certifying the right of their owner to purchase an apartment subject to the acquisition of a package of housing certificates or receipt from the issuer upon first request of the indexed nominal value of the housing certificate. The denomination of the certificate is established in units of the total area of housing (at least 0.1 m2), as well as in its monetary equivalent. Banks, credit institutions, commodity and stock exchanges can act as issuers.

Certificate of Deposit represents a written certificate of a credit institution (issuing bank) about the deposit of funds, certifying the owner’s right to receive, upon expiration of the established period, the amount of the deposit and interest on it. There are different types of certificates: personal and bearer; on demand and urgent. The attractiveness of the DS is that it can be transferred to another person.

Savings certificate jar has the same mechanism of action as a certificate of deposit, but is intended exclusively for individuals. The certificate can be issued for a certain period or on demand. In case of early return of funds under a term certificate at the initiative of its owner, a reduced percentage is paid, the amount of which is indicated in the agreement concluded when depositing money for storage.

Bill of exchange represents unconditional written promissory note the drawer to pay, upon maturity, the amount of money indicated in the bill to the owner of the bill (the holder of the bill).

As a promissory note, a bill of exchange has four essential features:

ü abstractness, which consists in the fact that, having arisen as a result of a certain transaction, a bill is isolated from it and exists as an independent document;

ü indisputability, consisting in the fact that the holder of the bill is free from objections that may be raised in relation to other parties to the bill of exchange agreement;

ü right to protest, allowing the holder of the bill, if the debtor does not pay the bill, to make a protest, i.e., the next day after the expiration of the payment date, to officially certify the fact of refusal to pay in the notary’s office at the location of the payer;

ü joint liability, consisting in the fact that if a protest is made in a timely manner, the holder of the bill has the right to bring a claim against all persons associated with the circulation of this bill, and against each of them separately, without being forced to comply with the sequence in which they obliged.

Bills of exchange may be upon presentation(payment period is not specified, payment is made upon presentation of the bill) and urgent(indicating either the exact date of payment, or the period from the moment of drawing up the bill, after which it must be paid, or the period from the moment of presentation of the bill, during which it must be paid).

There are bills of exchange simple and transferable.

In operation with promissory note There are two parties involved: the drawer, who is obligated to pay the bill, and the holder of the bill, who has the right to receive payment.

Bill of exchange(draft) is issued and signed by the creditor (drawer) and represents order to the debtor(drawee) about payment within the specified period the amount indicated in the bill to a third party- the first holder (recipient).

Bills of exchange have become more widespread in practice. A bill of exchange can be transferred from one holder to another through a special endorsement - endorsement, completed endorser on the reverse side of the bill or if there is not enough space for transfer notes on additional sheet - allonge.

Through endorsement, a bill of exchange can circulate among an unlimited number of persons, turning into a means of repaying debt claims.

For the order of the drawer to be valid, the drawee must confirm your consent make payment within the period specified in the bill. This consent is called acceptance, is drawn up with an inscription on the front side of the bill (“accepted”, “I undertake to pay”, etc.) and is accompanied by the signature of the drawee.

The most liquid are bills of exchange secured guarantee of large banks in the form of a special inscription on the bill - avalya .

Aval can be drawn up either on the front side of the bill, or on an additional sheet, or in the form of a separate document. The person who committed the aval bears joint liability with the debtor for payment of a bill.

Distinguish treasury, banking and commercial bills.

Treasury bill issued by the government and represents a short-term obligation of the government with a maturity of three, six or twelve months.

Bank bill issued by a bank or an association of banks (issuing syndicate). Income holder of a bank bill calculated as difference between price repayment , equal to the nominal value, and at the cost sales, carried out on discount terms.

Commercial bill used for lending trading operations. The transaction usually involves a bill of exchange, and the bank acts as the remittor. The procedure for the drawer to contact the remitting bank with an accepted bill of exchange in order to receive money in return is called bill discounting. Amount of credit , issued in this case by the bank to the drawer, less than the amount specified in bill of exchange ; this difference is bank income.

Most organizations account for some kind of debt financial assets (trade receivables, bills of exchange, loans issued, bonds, etc.). It is therefore important to understand the issues that arise when initially applying IFRS 9 Financial Instruments to debt financial instruments.An organization in the process of doing business is faced with various types of debt financial assets. But not all types of such assets are covered by IFRS 9. Thus, the scope of its application does not include:

- lease receivables [but the derecognition and impairment requirements of IFRS 9 apply to lease receivables recognized by the lessor];

- claims arising from employers under employee benefit plans to which IAS 19 Employee Benefits applies;

- rights of claim under insurance contracts (except for contracts of financial guarantees) and rights of claim under contracts containing conditions for discretionary participation;

- financial instruments, contracts and obligations in those share-based payment transactions to which IFRS 2 Share-based Payment applies;

- rights to receive payments to offset the costs that an entity must make to settle a liability that it recognizes as a provision in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets, or for which it has previously recognized provision in accordance with IAS 37;

- rights that are financial instruments and within the scope of IFRS 15 Revenue from Contracts with Customers, other than those that IFRS 15 requires to be accounted for in accordance with this Standard [para. 2.1 IFRS 9]; however, for the purposes of recognizing gains or losses from impairment of rights, which, according to IFRS 15, are accounted for in accordance with this standard, the requirements of this standard regarding impairment are applied [p. 2.2 IFRS 9].

Accounting for debt financial assets on initial application of IFRS 9

When applying IFRS 9 for the first time, debt financial assets (promissory notes, receivables, loans issued, etc.) should be classified based on the facts and circumstances existing on the day on which IFRS 9 is first applied [para. 7.2.3 IFRS 9]. For most entities, the initial application date of IFRS 9 will be 1 January 2018. It is on this date that it is necessary to determine within which business model the financial asset is held. IFRS 9 allows debt financial assets to be accounted for under one of the following business models:- business model, the purpose of which is to hold financial assets in order to receive contractual cash flows [p. 4.1.2 IFRS 9];

- business model, the goal of which is achieved both by receiving contractually stipulated cash flows and by selling financial assets [p. 4.1.2 IFRS 9].

The accounting of debt financial assets (bills, bonds, trade receivables, etc.) will depend on the chosen business model. Thus, a financial asset is accounted for at amortized cost if the following conditions are simultaneously met:

- the financial asset is held within the framework of a business model, the purpose of which is to hold the financial assets to collect contractual cash flows;

- The contractual terms of the financial asset provide for the receipt on specified dates of cash flows that are solely payments of principal and interest on the outstanding principal amount [p. 4.1.2 IFRS 9].

- the financial asset is held within the framework of a business model, the objective of which is achieved both by collecting contractual cash flows and by selling financial assets;

- The contractual terms of the financial asset provide for the receipt on specified dates of cash flows that are solely payments of principal and interest on the outstanding principal amount [p. 4.1.2A IFRS 9].

Example 1

Accounting for issued loans at fair value

Organization A issued bonds for 5 billion rubles. With the money raised as a result of the placement of bonds, rights of claim under loan agreements were acquired. It is known that changes in the fair value of acquired claims under loan agreements and issued bonds tend to cancel each other out. Organization A regularly buys and sells bonds of its own issue. But it does not sell the above-mentioned claims under loan agreements. In this case, accounting for both claims and bonds at fair value through profit or loss eliminates the inconsistency in the timing of recognition of gains and losses. Otherwise, such a discrepancy would arise in connection with the measurement of claims under loan and bond agreements at amortized cost, as well as in connection with the recognition of gain or loss on each repurchase of bonds.

Another important issue arises regarding the entity's ability to designate debt financial assets as measured at fair value through profit or loss at the date of initial application of IFRS 9. An entity has this option. As of the date of initial application of IFRS 9, an entity has the discretion to designate a financial asset as measured at fair value through profit or loss in accordance with paragraph 4.1.5 of IFRS 9. This decision must be made on the basis of the facts and circumstances existing at the date of initial application of IFRS 9. The classification chosen should be applied retrospectively [para. 7.2.8 IFRS 9].

You should also pay attention to the situation when, before the date of initial application, a debt financial asset (bond, bill, issued loan, etc.) had already been classified, at the discretion of the organization, into the category of financial assets accounted for at fair value through profit or loss.

At the date of initial application of IFRS 9, the financial asset must, in effect, be reclassified. If it is determined that, at the date of initial application, a debt financial asset should not be classified as at fair value through profit or loss because doing so would not eliminate or significantly reduce the accounting mismatch, the entity should reverse its previous decision. The decision to cancel must be made on the basis of the facts and circumstances existing at the date of initial application of IFRS 9. And the new classification of financial asset chosen must be applied retrospectively [para. 7.2.9 IFRS 9]. If it is determined that an asset can be classified as measured at fair value through profit or loss because it would eliminate or significantly reduce an accounting mismatch, the entity still has the right to reclassify that asset on the date it initially applies IFRS 9. At the date of initial application, an entity may reverse its previous designation of a financial asset as measured at fair value through profit or loss, even if accounting for that financial asset at fair value eliminates or significantly reduces the accounting mismatch [para. 7.2.9 IFRS 9]. The decision to withdraw a previous classification must be based on the facts and circumstances existing at the date of initial application of IFRS 9. However, the new classification chosen must be applied retrospectively.

In some cases, at the date of initial application of IFRS 9, an entity may determine that a debt financial asset previously measured at fair value through profit or loss is now accounted for at amortized cost. As discussed above, if, at the date of initial application of IFRS 9, an entity decides to account for a debt financial asset at amortized cost, that decision must be applied retrospectively. Therefore, it is necessary to apply the effective interest rate method retrospectively. But in some cases, retrospective application of the effective interest rate method may be impracticable for an organization. In such situations, the organization should consider:

- The fair value of the relevant financial asset, determined at the end of each comparative period presented, as the gross carrying amount of that financial asset if the entity restates prior periods;

- the fair value of the relevant financial asset determined at the date of initial application of IFRS 9 as the gross carrying amount of that financial asset in the new category at the date of initial application of IFRS 9 [para. 7.2.11 IFRS 9].

Impairment of debt financial assets

IFRS 9 contains fundamentally new rules for accounting for the impairment of debt instruments. To better understand them, let us remember what requirements for accounting for impairment of debt instruments are imposed by IAS 39.According to paragraph 46 of IAS 39, all financial assets, except those measured at fair value through profit or loss, are subject to impairment testing. At the end of each reporting period, it should be assessed whether there is objective evidence that a financial asset or group of financial assets is impaired [p. 58 IAS 39]. According to paragraph 59 of IAS 39, a financial asset or group of financial assets is impaired and impairment losses arise only if there is objective evidence of impairment as a result of one or more events that occurred after the initial recognition of the asset. Such loss events affect the expected future cash flows of a financial asset or group of financial assets, the amount of which can be measured reliably. If there is objective evidence of an impairment loss on loans and receivables or held-to-maturity investments carried at amortized cost, the amount of the loss is measured as the difference between the asset's carrying amount and the present value of estimated future cash flows (excluding future credit losses, which were not incurred), discounted at the financial asset's original effective interest rate [p. 63 IAS 39].

IAS 39 requires recognition of only incurred losses from impairment of a financial asset. In practice, according to IAS 39, losses are recognized when the debtor fails to repay its debt on the due date specified in the contract. Expected losses, in accordance with IAS 39, should not be reflected in IFRS financial statements. This approach to recognizing losses from impairment of financial assets has repeatedly been subject to serious criticism. According to users of IFRS financial statements, as a result of applying these recognition rules, impairment losses were reflected in the financial statements too late, after they had already been incurred. In fact, users of the organization's financial statements were presented with a fait accompli by informing them on the pages of the IFRS statements that the organization's financial assets had become worthless.

Taking into account these criticisms and taking into account the shortcomings of the model for accounting for impairment losses contained in IAS 39, the IASB decided to approve new rules for accounting for impairment losses. Therefore, the new standard for financial instruments, IFRS 9, contains fundamentally different rules for recognizing not only incurred, but also expected losses from the impairment of financial assets.

According to clause 5.5.1 of IFRS 9, an allowance for expected credit losses must be recognized for the following categories of financial assets:

- financial assets measured at amortized cost [p. 4.1.2 IFRS 9];

- debt financial assets measured at fair value through other comprehensive income [p. 4.1.2A IFRS 9];

- rent receivables;

- contract asset.

Example 2

Debt instrument measured at fair value through other comprehensive income

Organization K buys a bond with a fair value of RUB 1,000 on December 15, 2016. and measures it at fair value through other comprehensive income. The interest (also effective) rate on the bond is 5% per annum. The bond was issued for a period of 10 years. At initial recognition, the entity determined that the bond is not a credit-impaired financial asset.

The initial recognition of the bond is reflected in the accounting of organization K with the following entries:

Dt“Financial asset accounted for at fair value through OCI”—RUB 1,000.

CT

Payment of the bond price is reflected in the following entry:

Dt“Other accounts payable” - 1000 rubles.

CT“Cash and equivalents” - 1000 rubles.

As of December 31, 2016 (i.e., the reporting date), the fair value of the debt instrument decreased to RUB 950. as a result of changes in market interest rates. The entity has determined that there has been no significant increase in credit risk since initial recognition and that expected credit losses should be measured at an amount equal to 12-month expected credit losses, which is RUB 30. Therefore, as of December 31, 2016, the decrease in the fair value of the bond is reflected in the following entries:

Dt“Losses from impairment” - 30 rubles.

Dt

CT“Financial asset accounted for at fair value through OCI”—RUB 50.

The cumulative loss for other comprehensive expenses at the reporting date amounted to 20 rubles. This amount consists of the total change in fair value of RUB 50. (1000 rubles - 950 rubles), compensated by a change in the accumulated amount of impairment by 30 rubles, that is, expected credit losses for 12 months.

On 01/01/2017, the organization decides to sell the bond at a price of 950 rubles, which is its fair value as of this date.

Dt“Cash” - 950 rubles.

CT“Financial asset accounted for at fair value through OCI”—RUB 950.

Dt“Loss from impairment” - 20 rubles.

CT“Other comprehensive income (expense)” - 20 rubles.

The last transaction is for the amount of 20 rubles. is done in order to stop recognizing the amount of loss from the revaluation of a bond accumulated in other comprehensive income (expense). The amount accumulated in other comprehensive income (loss) is reclassified to profit or loss on the date the bond is sold.

For purposes of applying the above rules, a credit loss is the difference between all contractual cash flows due under the contract and all cash flows the entity expects to receive, discounted at the original effective rate. For acquired or originated credit-impaired assets, the effective interest rate adjusted for credit risk is used for this discounting.

At each reporting date, the allowance for losses on a financial asset must be measured in an amount equal to lifetime expected credit losses if the credit risk on that financial asset has increased significantly since initial recognition [para. 5.5.3 IFRS 9]. However, some exceptions must be taken into account.

Let's look at two examples of accounting for impairment losses: in accordance with IAS 39 and IFRS 9.

Example 3

Measuring credit losses under IAS 39

Organization D issued a loan to organization F in the amount of 1 million rubles. The loan term is 10 years. At initial recognition, Entity D determined that the loan originated has a 0.5% probability of default within the next 12 months. The probability of default assessment is based on expectations for instruments with similar credit risk (using reasonable and supportable information that is available without undue cost or effort), and also takes into account the borrower's credit risk and economic forecast for the next 12 months.

According to paragraph 58 of IAS 39, at the end of each reporting period, an organization must assess whether there is objective evidence that a financial asset or group of financial assets is impaired. It is considered that a financial asset or group of financial assets has been impaired and impairment losses have been incurred only if there is objective evidence of impairment. At the same time, losses expected as a result of future events are not recognized regardless of the degree of probability of their occurrence [p. 59 IAS 39].

Since there is no objective evidence that the financial asset is impaired at the reporting date, Entity D does not recognize any impairment losses on loans. Losses expected to result from future events are not recognized.

Now, for comparison, let’s look at how impairment losses are accounted for in this case in accordance with IFRS 9.

Example 4

Estimation of 12-month expected credit losses

Organization D issued a loan to organization F in the amount of 1 million rubles. The loan term is 10 years. At initial recognition, Entity D determined that the loan originated has a 0.5% probability of default within the next 12 months. The probability of default assessment is based on expectations for instruments with similar credit risk (using reasonable and supportable information that is available without undue cost or effort), and also takes into account the borrower's credit risk and economic forecast for the next 12 months. Entity D also determines that changes in the 12-month probability of default are a reasonable approximation of changes in the probability of default over the life of the loan in determining whether there has been a significant increase in credit risk since the initial recognition of the loan.

At the reporting date prior to the maturity date, it was determined that there had been no change in the probability of default (in the next 12 months) since the initial recognition of the loan originated. Entity D therefore determined that credit risk has not increased significantly since initial recognition. In addition, Entity D has determined that 25% of the gross book value of the loan originated could be lost if there were a default.

Therefore, Entity D measures the allowance at an amount equal to 12-month expected credit losses using a 12-month probability of default of 0.5%. As a result, as of the reporting date, the provision for losses for expected credit losses for 12 months is RUB 1,250. (0.5% × 25% × 1 million rubles).

Simplified approach for trade receivables, contract assets and lease receivables

According to paragraph 5.5.15 of IFRS 9, an entity should always determine a loss allowance in an amount equal to lifetime expected credit losses for trade receivables or contract assets that arise from transactions within the scope of IFRS (IFRS) 15, and which:- do not contain a significant financing component in accordance with IFRS 15 [or when the entity applies the practical expedient in paragraph 63 of IFRS 15];

- contain a significant financing component in accordance with IFRS 15 if the entity chooses as its accounting policy to determine the loss allowance in an amount equal to lifetime expected credit losses; This accounting policy must be applied to all such trade receivables or all such contract assets, but may be applied separately to trade receivables and contract assets.

In this case, the organization can choose accounting policies for trade receivables, lease receivables and contract assets independently of each other [p. 5.5.16 IFRS 9].

Example 5

Reserve Matrix

Organization E, which produces building materials, has a portfolio of trade receivables totaling RUB 30 million. Organization E sells building materials only in the Moscow region; its extensive customer base consists of small businesses and individuals. Accounts receivable from customers are classified according to general risk characteristics that characterize the ability of customers to pay all amounts due in accordance with the terms of the contracts.

Trade receivables do not have a significant financing component. And in accordance with paragraph 5.5.15 of IFRS 9, the provision for such trade receivables is always measured in an amount equal to expected credit losses for the entire life of the financial asset.

To determine the expected credit losses for the trade receivables portfolio, Entity E uses an allowance matrix that is based on historical observed default rates over the expected life of the trade receivables and adjusted by forward estimates. At each reporting date, historical observed default rates are updated and changes in forward estimates are analyzed. In this case, economic deterioration is predicted

conditions over the next year.

Taking into account the above, Entity E has compiled the following reserve matrix:

| Debt | Default rate, % |

| Current | 0,3 |

| Overdue: | |

|

1,6 |

|

3,6 |

|

6,6 |

|

10,6 |

Trade receivables from a large number of customers amount to RUB 30 million. and is assessed using the reserve matrix:

| Debt | Gross book value, million rubles. | Provision for expected credit losses for the entire period, RUB million. |

| Current | 15 | 0,045 (0.3% × 15) |

| Overdue: | ||

|

7,5 | 0,12 (1.6% × 7.5) |

|

4 | 0,144 (3.6% × 4) |

|

2,5 | 0,165 |

|

1 | 0,106 (10.6% × 1) |

| Total | 30 | 0,58 |

Purchased or originated credit-impaired financial assets

Credit-impaired financial assets are those financial assets that have experienced one or more events that have a negative impact on their estimated future cash flows. Evidence of credit impairment of a financial asset includes, inter alia, observable data on the following events:- significant financial difficulties of the debtor;

- violation of the terms of the contract (default or late payment);

- granting to a debtor concessions for economic reasons or contractual terms related to the financial difficulties of such debtor that would not have been granted otherwise;

- increasing the likelihood of bankruptcy or other financial reorganization of the debtor;

- the disappearance of an active market for a given financial asset as a result of financial difficulties;

- the purchase or creation of a financial asset at a deep discount that reflects the credit losses incurred.

IFRS 9 sets out special rules regarding the accounting for impairment of credit-impaired assets. Thus, at the reporting date, an organization must recognize as an allowance for losses on acquired or originated credit-impaired financial assets only changes in lifetime expected credit losses that have accumulated since initial recognition [p. 5.5.13 IFRS 9].

For credit-impaired assets, an entity must recognize in profit or loss at each reporting date the amount of the change in lifetime expected credit losses. However, it should recognize favorable changes in lifetime expected credit losses as an impairment gain, even if the lifetime expected credit losses are less than the expected credit losses that were included in the estimated cash flows at initial recognition [para. 5.5.14 IFRS 9].

The basic rules of the new impairment accounting model can be formulated as follows.

If, at the reporting date, there has been no significant increase in the credit risk of a financial instrument since initial recognition, the entity shall determine the loss allowance for that financial instrument in an amount equal to 12-month expected credit losses [para. 5.5.5 IFRS 9]. But if the credit risk of a financial instrument has increased significantly since initial recognition, the loss allowance should be determined at the amount of expected credit losses over the entire expected life of the financial asset [para. 5.5.3 IFRS 9]. However, in future periods, the credit risk on financial instruments may decrease significantly, and then there will be no reason to assert that credit risk has increased significantly since the date of initial recognition of the financial instrument. In this case, at the relevant reporting date, the entity will determine the allowance in an amount equal to 12-month expected credit losses [p. 5.5.7 IFRS 9].

Determining a Significant Increase in Credit Risk

Let's consider what should be understood by a significant increase in credit risk and how to determine that credit risk has increased significantly, since in accordance with paragraph 5.5.9 of IFRS 9, as of each reporting date, it is necessary to assess whether credit risk has increased significantly financial instrument from the moment of its initial recognition. When determining whether an increase in credit risk is significant, an entity should focus on changes in the risk of default over the expected life of the financial instrument rather than changes in the amount of expected credit losses. In this case, it is necessary to compare the risk of default on a financial instrument as of the reporting date with the risk of default on such a financial instrument at the date of initial recognition. In addition, reasonable and supportable information, available without undue cost or effort, that indicates a significant increase in credit risk since the initial recognition of the relevant instrument should be reviewed.It should also be borne in mind that an entity may use the assumption that the credit risk of a financial instrument has not increased significantly since initial recognition if the financial instrument is determined to have low credit risk at the reporting date [para. 5.5.10 IFRS 9].

When assessing the significance of the increase in credit risk on a financial asset, you need to remember the following rules.

In accordance with paragraph 5.5.11 of IFRS 9, if reasonable and supportable forward-looking information is available without undue cost or effort, past due payment information alone cannot be relied upon in determining whether credit risk has increased significantly since initial recognition. However, when information that is more predictive than delinquency status (whether on an individual or group basis) is not available without undue cost or effort, an entity may use delinquency information in determining whether credit risk has increased since initial recognition. However, regardless of how an entity assesses a significant increase in credit risk since initial recognition, if contractual payments are more than 30 days past due, a rebuttable presumption is applied that the credit risk of the financial asset has increased significantly since initial recognition. This presumption can be rebutted if there is reasonable and supportable information available without undue cost or effort that shows that credit risk has not increased significantly since initial recognition, even though contractual payments are more than 30 days past due. But if an entity determines that credit risk increased significantly before contractual payments were more than 30 days past due, this rebuttable presumption does not apply.

Example 6

Significant increase in credit risk

Bank A provided a loan to organization B. By providing the loan, the bank expected that organization B would comply with all the terms of the loan agreement during the entire term of the loan. In addition, it was assumed that revenue and cash flows would be stable for all enterprises in the industry to which organization B belongs.

On initial recognition of the loan, Bank A considered that the loan should not be recognized as a credit-impaired financial asset because it did not meet the definition of such an asset in Appendix A to IFRS 9.

Following the initial recognition of the loan origination, macroeconomic changes had a negative impact on overall sales. Entity B's actual revenue and actual net cash flow were less than planned. At the same time, reserves increased. In need of financing, the organization borrowed more money under a separate revolving credit line agreement, thereby increasing its financial leverage ratio. As a result, organization B was close to violating its obligations under the loan received from bank A.

At the reporting date, Bank A makes an overall assessment of the credit risk of the loan to Entity B, taking into account all reasonable and supportable information available without undue cost or effort that is appropriate to determine the extent of the increase in credit risk. When assessing the degree of increase in credit risk, Bank A takes into account the following factors:

- deterioration of macroeconomic conditions may continue in the near future, which is expected to have a further negative impact on Entity B's ability to generate cash flows and repay long-term loans;

- Entity B is close to breaching covenants, which may result in the need to restructure the loan or revise the covenants;

- Entity B's bond prices have fallen, reflecting an increase in credit risk, and this cannot be explained by changes in the capital market (in particular, interest rates have remained unchanged);

- Bank A has reassessed its internal assessment of loan risk based on information available to it to reflect the increase in credit risk.

Bank A has determined that there has been a significant increase in credit risk since the initial recognition of the loan to Entity B.

Bank A therefore recognizes expected credit losses over the life of the loan agreement. And even if he had not changed his internal assessment of credit risk, this would not have influenced the decision to significantly increase credit risk. After all, the absence or presence of a change in the internal risk assessment does not in itself affect the decision on the extent to which credit risk has increased since initial recognition. It should also be noted that the presence of collateral on a loan affects the loss that will be realized in the event of default, but does not affect the risk of default. Therefore, the presence of loan collateral is not taken into account in determining whether there has been a significant increase in credit risk since initial recognition.

Modified financial assets

If the terms of the contractual cash flows of a financial asset have been renegotiated or modified and the financial asset is not derecognised, an entity shall assess whether the credit risk of the financial instrument has increased significantly by comparing:- assessment of the risk of default as of the reporting date (based on modified contractual terms);

- assessing the risk of default upon initial recognition (based on the original unmodified contractual terms) [p. 5.5.12 IFRS 9].

Estimation of expected credit losses

According to paragraph 5.5.17 of IFRS 9, an entity must measure expected credit losses for a financial instrument in a manner that reflects:- an unbiased, probability-weighted amount determined by assessing the range of possible outcomes;

- time value of money;

- reasonable and supportable information about past events, current conditions and projected future economic conditions that is available at the reporting date without undue cost or effort.

The maximum period considered in measuring expected credit losses is the maximum contractual period (including extension options) over which the entity is exposed to credit risk, not a longer period, even if consistent with business practice [para. 5.5.19 IFRS 9].

However, some financial instruments contain both a loan and an undrawn commitment component, and an entity's contractual ability to call for repayment of a loan and cancel the undrawn commitment component does not limit the entity's exposure to credit losses to the contractual notice period. For such financial instruments only, an entity must estimate expected credit losses for the entire period during which it is exposed to credit risk, and the expected credit losses will not be reduced as a result of the entity's credit risk management activities, even if such period exceeds the maximum contractual period. . 5.5.20 IFRS 9].

On initial application of IFRS 9, the impairment requirements must be applied retrospectively in accordance with IAS 8 [para. 7.2.17 IFRS 9]. However, at the date of initial application of IFRS 9, it is necessary to use reasonable and supportable information (available without undue cost or effort) to determine the credit risk of a financial instrument at the date of initial recognition. This credit risk at the date of initial recognition should be compared with the credit risk at the date of initial application of IFRS 9 [para. 7.2.18 IFRS 9].

In determining whether there has been a significant increase in credit risk since the initial recognition of a financial asset, an entity may apply:

- requirements provided for in paragraphs. 5.5.10 and B5.5.22-B5.5.24 IFRS 9;

- rebuttable presumption required by clause 5.5.11 of IFRS 9 for contractual payments that are more than 30 days overdue if the entity will apply impairment requirements to those financial instruments by identifying a significant increase in credit risk from the moment of their initial recognition based on information about late payments [p. 7.2.19 IFRS 9].

All of the above makes it clear that IFRS practitioners will have a lot of work to do both when initially applying IFRS 9 and subsequently when preparing financial statements in future periods. After all, the new standard for financial instruments requires the formation of impairment reserves for almost all debt financial assets. This means that there will be more work on the formation and restoration of reserves for the depreciation of receivables, loans issued and other debt financial assets. In addition, in many cases, entities will recognize more losses due to the application of the new rules for accounting for impairment losses set out in IFRS 9. It is therefore advisable to understand in advance what the consequences of applying IFRS 9 will be and to prepare for it. new to take into account the depreciation of financial assets.

Debt financial instruments characterize the credit relationship between their buyer and seller and oblige the debtor to repay their nominal value within a specified period and pay additional remuneration in the form of interest.

The main debt Finnish. instruments are various loans, bonds, bills, leasing.

Credit expresses the economic relations between the lender and the borrower that arise in the process of transferring money or other material assets from one party to the agreement to another on the terms of repayment, urgency and payment. The most common types of loans: mortgage, car loan, consumer, land, educational, brokerage loans.

Leasing means a form of long-term lease associated with the transfer of property (i.e., an object, an object) for use for business activities. The subject of leasing can be any non-consumable things (enterprises, property complexes, buildings, structures, equipment, vehicles and other movable and immovable property) that can be used for business activities. The leasing transaction involves: the lessor, the lessee and the seller of the leased asset.

The lessor is an economic entity (leasing company, bank, etc.) or an individual entrepreneur carrying out leasing activities, i.e. transfer under a leasing agreement of property specially acquired for this purpose. In other words, the lessor is the lessor of the property.

A lessee is a citizen or business entity that receives property for use under a leasing agreement. Thus, the lessee is the lessee.

The seller of leased property is an economic entity - a manufacturer of machinery and equipment, as well as another economic entity or citizen selling property that is the subject of leasing.

Bond- an issue-grade debt security that secures the right of its owner to receive from the issuer a bond within the period specified in it, its nominal value or other property equivalent. A bond may also provide for the right of its owner to receive a fixed percentage of the nominal value of the bond or other property rights. The yield on a bond is interest and/or discount. Bonds are one of the most common types of debt financial instruments.

Bill of exchange- also a common debt financial instrument, a written obligation of the borrower to pay a certain amount to the creditor upon the expiration of the period specified in it.

A bill of exchange is characterized, first of all, by its abstractness. It does not indicate the circumstances that gave rise to this debt obligation. The only thing that is indicated in the bill is how much money and within what period the borrower must pay the lender. This implies another property of a bill of exchange obligation - its indisputability. A person obligated to pay a bill does not have the right to dispute his obligation. Another important feature of a bill of exchange is its negotiability. Bills of exchange can be simple or transferable. A promissory note is a written obligation issued by a debtor to a creditor for payment upon maturity. A bill of exchange is a written obligation issued by the debtor to the creditor for payment upon the expiration of the term to the creditor or to whomever he specifies.

7. Financial planning in the corporate governance system: goals and types

Financial planning is the main function of enterprise financial management. Planning financial indicators allows the owner and management of the company to imagine the future financial state of both the enterprise as a whole and its individual business units, and timely assess the need for financial resources for the further development of the enterprise. The main goal of financial planning is to determine the possible volumes of financial resources, capital and reserves based on forecasting the amount of cash flows from own, borrowed and sources of financing attracted from the stock market.

This goal implies:

- ensuring the production, scientific, technical and social development of the corporation, primarily at its own expense;

- increase in profits mainly due to increased sales volumes and reduced production and distribution costs;

- ensuring financial stability, solvency and liquidity of the corporation’s balance sheet, especially during the implementation of large-scale investment projects.

Financial plan- this is a generalized planning document reflecting the receipt and expenditure of funds for the current (up to one year) and long-term (over one year) period. This plan is necessary to obtain a high-quality forecast of future cash flows. To determine the financial potential for the current and long-term periods, enterprises (corporations) have the right to develop several types of financial plans (budgets). Types of financial plans that can be developed by enterprises (corporations):

- Plan (balance) of income and expenses - quarter, half-year, year.

- Investment plan (budget) - quarter, half-year, year.

- Distribution plan for accounting and net profit - quarter, half-year, year.

- Balance of payments (calendar) - for a month with a ten-day breakdown of indicators.

- Credit plan - quarter, half-year, year.

6. Currency plan - quarter, half-year, year.

7. Tax budget - quarter, half-year, year.

8. Cash flow budget - month, quarter, half year, year.

9. Budget according to the balance sheet (forecast of the balance of assets and liabilities at the end of the upcoming quarter).

10. Budget for the formation and financing of current assets - quarter, year.

11. Break-even chart (an integral element of the business plan).

Modern capital market theory states that the value of financial instruments depends on the cash receipts or payments generated by the financial instrument in the future. Thus, an abstract cash flow model can be used to describe an arbitrary financial instrument.

Cash flow model represents a set of cash payments received at different points in time. Cash payments can have a positive sign - this means that the holder of this cash flow receives a payment; and a negative sign if the cash flow holder makes a payment.

Depending on the nature of payments, cash flows can be divided into three types: cash flows with certain, uncertain and conditional payments.

Certain cash flows– these are those for which at the time of assessment the values of future payments and the moments of their receipt are known. Financial instruments that can be described using a specific cash flow model include debt instruments. For example, coupon bonds with a fixed coupon rate or bank deposits with a fixed rate.

Uncertain Cash Flows assume unknown future payments. The amount of future payments in such cash flows is considered as a random variable with some probability distribution function. Using the uncertain cash flow model, you can describe financial instruments that have an equity nature, such as shares.

Conditional cash flows assume that future payments are equal to a certain amount if some condition is met. The conditional cash flow model is used to describe financial instruments such as options.

The basis for assessing the value of cash flows is the idea of the time value of money. Amounts of money of the same size that come to the disposal of an economic entity at different points in time differ in their value for it. A ruble today turns out to be more valuable than a ruble that may arrive in a year. This happens because today’s ruble can be invested in an income-generating asset and in a year you will receive an amount greater than one ruble by the amount of interest payments. Thus, in order to compare amounts of money received at different times, it is necessary to bring them to one point in time. For this purpose, discounting and compounding operations are used.

Discounting– bringing cash flows at different times to the initial moment.

Extension– bringing multi-temporal cash flows to a future point in time.

Discounting and accretion operations are carried out taking into account the possibility of an alternative deposit with returns in the form of periodic interest payments. Interest payments can be calculated in various ways.

There are two interest calculation schemes in practical use: simple and compound interest.

Simple interest scheme - accrual of interest payments without taking into account accumulated income (without taking into account reinvestment of interest payments).

Compound Interest Scheme– calculation of interest payments taking into account accumulated income (including reinvestment of interest payments).

Let FV be the future value, PV be the current value, r be the interest rate on the alternative deposit, measured in fractions of a unit, t be the number of periods for calculating interest payments (time). Using the simple interest scheme we can write:

FV = PV / (1 + rt).

According to the compound interest scheme:

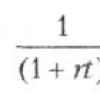

FV = PV / (1 + r) t .

Here the factors (1 + rt) and (1 + r) t are called increment factors. Or relative to the current value:

Here are the multipliers:

are called discount factors.

Most often, the calculation of simple interest is used when assessing the cost and profitability of short-term financial instruments (with a maturity of up to one year), and the compound interest scheme is used when calculating medium- and long-term financial instruments (with a maturity of more than one year).

Debt financial instruments can be represented as a cash flow model with certain future payments. We will consider a classic coupon bond as the object of evaluation, although the model can also be used to evaluate bank loans and deposits, bank deposit and savings certificates, discount bonds and bills.

Consider a bond with a face value N, repayment period T(years), coupon interest q and annual coupon payment. We will denote the rate on an alternative deposit r.

Such a bond creates the following cash flow of payments:

QN every year for T years,

In the year T face value payment is added N.

This bond is called bond with a constant coupon. To estimate its value, you can apply a certain cash flow model, so that its theoretical value will be equal to:

PV = + + …+ ![]() = qN∙

= qN∙ ![]()

The price of bonds is only one characteristic of them. Several other characteristics are used to describe bonds. The indicator used coupon yield of the bond, which is the coupon rate q. We can talk about current bond yield, which is calculated as the ratio of the annual coupon payment to the market value of the bond.

The most important and accurate characteristic of a bond is its yield to maturity, which is equal to the internal rate of return of the cash flow generated by this bond. Bond yield to maturity (r) can be calculated by solving the following equation where R indicates the real market value of the bond relative to r:

The yield to maturity of a bond is a key characteristic of a bond because it reflects the market price of the debt, which is issued in the form of a bond. The market forms the bond's yield to maturity, and the market value is calculated as its theoretical value, where instead of the rate on an alternative deposit, the market indicator of the bond's yield to maturity is used.

The theoretical and market values of a bond may differ in relation to its face value. They can be greater than, less than, or equal to the par.

The coupon bond cost model can also be applied to calculating the cost discount bond taking into account that q= 0. A discount bond has a degenerate cash flow, consisting of one payment - the par value at the time of maturity of the bond. Since discount bonds often exist as short-term instruments, simple interest can be used to estimate their value. The cost of a discount bond under simple and compound interest schemes is respectively equal to:

The discount bond valuation model can be applied to estimate the value of promissory notes.

Most common equity instruments are preferred and ordinary shares. The main characteristics that describe the circulation of a stock on the market are the amount of dividend income and the exchange rate that corresponds to the price of the stock. The difference between preferred and common stock is the cash flow they generate.

Preference shares create a certain cash flow, since in accordance with Russian legislation the amount of dividends on preferred shares in most cases is determined or can be calculated. Common shares generate cash flow of uncertain magnitude.

Preferred share valuation model for the period is based on the assumption that the holding period of the share is limited in time and equal to T. During this period, the shareholder receives a stream of dividends, which are further designated Divt(t= 1,..., 7), and in the future can sell the share at a price R T . We also use the notation E – expected dividend value and E[R T]– the expected future value of the stock. Then the current share price R can be calculated using the following model:

The discount rate used here is the rate of the minimum acceptable return expected by the investor.

Ordinary shares generate uncertain cash flows, the valuation of which turns out to be quite a difficult task. Stocks are risky instruments compared to bonds because they carry the risk of uncertain cash flow returns. This means that an investor, when buying a share, will expect a higher return from it than from a similar (in terms of numerical characteristics) bond. In practice, to estimate the cost of capital raised through ordinary shares, the following is used:

· Gordon model;

· fixed asset valuation model (CAPM).

Gordon's model assumes that the company is currently paying dividends of D, which will increase evenly in the future at a constant rate g. The model can be presented as follows:

P – price (market) of an ordinary share at the time of valuation;

D – expected dividend within one year;

r – expected return of the stock;

g – dividend growth rate (it is assumed that it will be constant for the entire period).

Having transformed the model, we obtain the return on the stock or the cost of attracted capital in the form of ordinary shares (r):

An alternative approach to estimating the cost of capital raised through common stock is the capital asset pricing model (CAPM).

In order to use the CAPM model, you must have the following information:

1. level of risk-free income – r f . The CAPM model is based on the assumption that the return on a security is equal to the risk-free return plus a risk premium. In the United States, the benchmark for risk-free return is the three-month Treasury bill, which is considered a risk-free investment because it represents a direct obligation of the US government and has a maturity short enough to minimize the risks of inflation and changes in market interest rates. The risk-free rate can be considered the minimum return that an investor expects when dealing with stocks;

2. ß (beta) – stock ratio, which is an index of systematic (market) risk;

3. level of return on the market - r m, which is determined from a composite stock index (for example, Dow Jones 30 - a price-weighted average index that includes 30 shares of blue chip companies);

4. the expected level of return on ordinary shares of a company using the CAPM model.

The level of return (r), which will actually be the price (or cost) of the attracted capital in the form of ordinary shares, is determined by the formula

Previous notes were devoted to explanations of what is not an investment: , and .

And now let’s move directly to the investments themselves :) We can say that this post is the first in a number of posts about what types of investments there are. And while reading these materials, try to pay attention not only to the features of various types of investments, but also to the variety of possible options available. One of the tasks is to refute the popular opinion that “we have nowhere to invest” and show that, on the contrary, finding opportunities for investment is not a problem. The problem is completely different: to choose from this sea of available investment options those that are right for you.

Today we will talk about equity And debt investments.

Based on the nature of the relationship between the investor and the business, investments are divided into two classes - equity and debt. Equity – from the word “share”, debt – from the word “debt”. It is very important to understand the differences between them.

When equity investments you become a co-owner of the business or property in which you invest.

You become a co-investor - a co-founder, shareholder, shareholder, shareholder, in general, one of those who has a portion of the rights to the business as a whole. At the same time, on the one hand, you have certain rights in relation to the business, including rights to a part of the business’s profits, and on the other hand, you take on all the risks inherent in this business.

Examples equity investments:

Shares in a business (for example, a share in an LLC)

Stock

Units of investment funds - mutual funds or OFBU

At equity investments You get some rights to the business as a whole, including a share of the business's profits, but these rights do not include what many first-time investors expect: the right to a guaranteed return on the amount of money invested.

When purchasing a share in a business, you inevitably run the risk that the amount you invested may be significantly reduced in size. The business may go wrong, causing the value of your initial investment to be significantly eroded. Another option is also possible: due to changes in market conditions or a stock exchange crisis, there may not be anyone willing to purchase your shares at a high price, as a result their value will go down.

When equity investments you are NOT guaranteed not only any income, but even a return of the principal amount. The return is unknown in advance, and may well be negative (i.e. you may incur losses). However, the return on investment in equity instruments can be very high. Two- and even three-digit returns are not uncommon for a business (and, accordingly, for equity investments in a business) over certain periods of time that are favorable from the point of view of external conditions or other factors. However, it is impossible to accurately predict this in advance.

Another type of investment - debt investments. In this case, you do not acquire any rights to the business. You are simply lending money for a while.

At debt investments you only receive the right to a return on investments within a specified period and a reward for their use in an agreed amount. Debt investments are usually made on the terms of repayment, payment and urgency. In the case of debt investments, you are usually guaranteed a return of the principal amount within a specified time frame + some additional income. The size of this income is known or predicted in advance.

The word “guaranteed” here does not mean an absolute and unconditional guarantee. You may not get your investment back. debt investments, if the borrower by that time ceases to exist or begins to experience significant financial difficulties. However, if the borrower is in a satisfactory financial position, he must repay the debt to you. The main risk in debt investments, therefore, becomes credit risk - the risk of non-repayment of investments and interest on them.

Examples debt investments:

Credits, loans, advances

Bank deposits

Bonds

Bills of exchange

Certificates of deposit

When you deposit money in a bank or buy a bill of exchange, you already know the profitability of these instruments. This yield is usually low. It does not depend in any way on the success of the business to which you lent. If you lend money to a business at 20% per annum, then you will receive 20% per annum, even if the business in which you invested the money earns a profit of 1000%. On the other hand, if the business is unprofitable, you will still have to pay at a rate of 20% per annum (if, of course, they are able to do so).

You need to clearly understand that debt instruments do not have ultra-high guaranteed returns. If you are offered a high guaranteed return, this is a reason to be wary.

Comparison equity And debt investments

A comparison of capital change schedules for equity and debt investments is shown in the figure.

To illustrate behavior equity investments The RTS index is taken to illustrate debt investments - a bank deposit with a yield of 15% per annum and annual reinvestment of the principal amount and interest on it.

It is easy to see that the potential of equity investments is significantly higher, however, the risk of decline in market value is also high - during crises, investors can lose a significant part of their capital. The behavior of debt investments is much more predictable; the investor does not expect sharp declines in the value of his capital, however, the profitability of debt investments is significantly lower.

The main differences between debt and equity investments are summarized in the table:

The note was prepared using materials from the Investor's Notes blog: http://fintraining.livejournal.com/